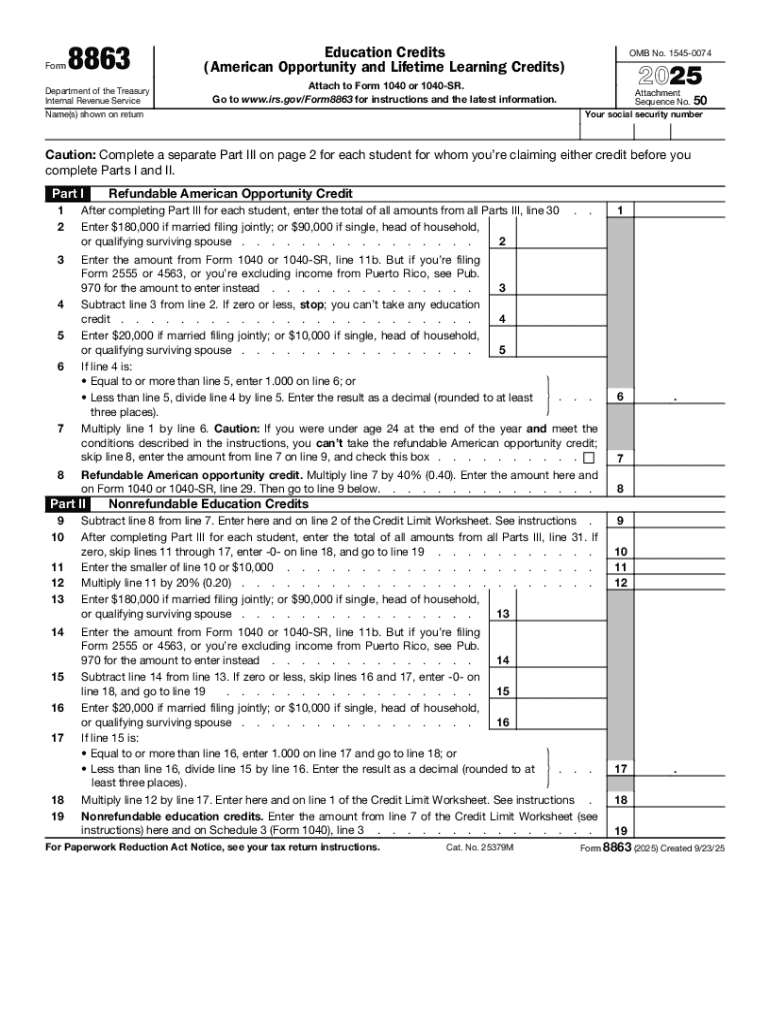

IRS 8863 2025-2026 free printable template

Instructions and Help about IRS 8863

How to edit IRS 8863

How to fill out IRS 8863

Latest updates to IRS 8863

All You Need to Know About IRS 8863

What is IRS 8863?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 8863

What should I do if I realize I made a mistake on my IRS 8863 after submitting?

If you discover an error on your IRS 8863 after submission, you can file an amended return using Form 1040-X. This allows you to correct the details on the form and ensure accurate information with the IRS. Remember to include a new IRS 8863 with your amended return for proper processing.

How can I track the status of my IRS 8863 submission?

To track the status of your IRS 8863 submission, you can use the IRS 'Where's My Refund?' tool on their website. This allows you to verify if your form has been received and when it is being processed. Additionally, keep an eye on any e-file rejection codes provided which guide you on what needs to be corrected.

Are e-signatures acceptable when submitting the IRS 8863?

Yes, e-signatures are generally acceptable for submitting the IRS 8863, provided you are filing electronically through approved tax software or authorized e-filing channels. Ensure to follow all instructions concerning e-signatures to maintain compliance with IRS regulations.

What common mistakes should I avoid when filing my IRS 8863?

Common mistakes include providing incorrect Social Security numbers, failing to include required documentation, or miscalculating education expenses. Double-check all entries and ensure your supporting documents align with the information on your IRS 8863 to minimize the risk of errors.

What should I prepare if I receive a notice from the IRS after filing my IRS 8863?

If you receive a notice from the IRS, prepare to review the specified concerns in the notice. Gather any documentation related to your IRS 8863 submission and respond promptly with the necessary information or corrections as requested by the IRS to address their inquiries.

See what our users say